Rochester Minnesota

Divorce & Family Attorney

How Can We Help You

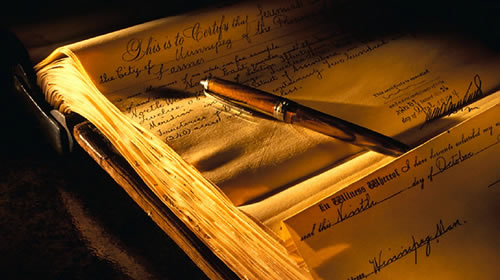

Rochester Minnesota Power of Attorney (POA) Lawyer

Minnesota Power of Attorney

A Power of Attorney is a document that grants another person (the fiduciary) legal authority to act on your behalf. There are different kinds of Power of Attorney documents and they can be as rigid or as flexible as you wish. Powers of Attorney usually fall under one of these categories:

- Durable Power of Attorney allows someone to act for you if you become incapacitated or disabled;

- Springing Power of Attorney becomes effective only upon incompetency; and

- Short Form Power of Attorney, typically used with financial institutions.

The main issues that typically come up with Powers of Attorney are the following:

- What kind of services do you want the fiduciary to do?

- What authority are you willing to grant the fiduciary?

- How often do you want the fiduciary to contact you?

- How will you be protected?

- How is the fiduciary going to get paid?

- How do you terminate it if the relationship is not working?

A Rochester Minnesota POA lawyer would be helpful to determine which power of attorney would work best given your circumstances.

Services that the Fiduciary can Provide Under a POA

There is a long list of services a fiduciary can ordinarily do, as needed, if given the task of managing a client’s personal or financial affairs. It is sometimes advisable to add specific items (e.g. make sure Dad goes to the park once a week). Sometimes, a fiduciary can be hired for a very limited purpose, such as handling the checkbook and paying monthly bills. The following is a list of items can be used to create an agreement that will adapt to the unique circumstances of each case.

Personal services that can be provided under a POA:

- Visits – usually monthly, more if circumstances warrant

- Coordinate medical care

- Prepare list of current providers/contact info/insurance info and pertinent medical records

- Arrange transportation and accompany client to medical appointments

- Make placement and housing decisions

- Find volunteers or hire supportive services to keep client at home

- Communicate directly with medical providers and receive reports

- Sign consents for medical and dental care

- Arrange for supportive services such as meals, home health care

- Pre-plan for end-of-life care, funeral and burial

Financial services that can be provided under a POA:

- Inventory current assets and request inventory from prior fiduciary

- Revoke prior POA, if any

- Create budget, pay routine monthly bills and reconcile accounts

- Transfer assets from investments or savings to checking as needed

- Pre-pay funeral and burial expenses

- Consult with attorney and financial advisers about estate plan

- Pursue claims to collect on debts owed to client

- Sign contracts for services on behalf of client

Reporting Requirements and Safeguards to a POA

Two ways to make sure that the fiduciary is not abusing the power given through the POA is to make sure there are safeguards in place and to require the fiduciary to provide regular reports. These reports can include medical updates at an agreed-upon interval, monthly reports of financials income and expenditures, and, at least yearly, financial account reports with verification of funds.

As indicated above, it is a good idea to have certain safeguards in place. If there are significant assets, a bond would be recommended. It is the only way to ensure that funds are replaced in case of theft by a fiduciary. A fiduciary should have insurance including auto, general liability, professional liability, and employee theft. You should also ask that monthly financial reports be sent to your family members as they are the most likely to spot questionable expenses.

Request a Free Consultation

If you have additional questions about Powers of Attorney in Minnesota, please contact the Dilaveri Law Firm today. We always offer free initial consultations to our clients. Call 507.206.6020 or complete our free case evaluation form.